28+ Dependent care fsa eligible expenses summer camp Pictures

Home » Camping Wallpaper » 28+ Dependent care fsa eligible expenses summer camp PicturesYour Dependent care fsa eligible expenses summer camp photo are available in this site. Dependent care fsa eligible expenses summer camp are a pictures that is most popular and liked by everyone now. You can Get the Dependent care fsa eligible expenses summer camp files here. Get all free images.

If you’re searching for dependent care fsa eligible expenses summer camp images information connected with to the dependent care fsa eligible expenses summer camp topic, you have come to the ideal site. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

Dependent Care Fsa Eligible Expenses Summer Camp. Though prices vary summer day camp programs accredited by the American Camp Association average 314 per week. 16 rows Various Eligible Expenses You can use your Dependent Care FSA DCFSA to pay for a. Take care of your family while making every dollar count. What is summer camp.

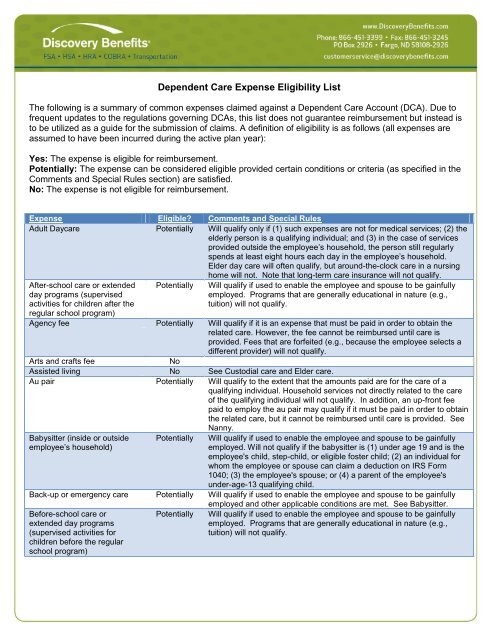

Dependent Care Expense Eligibility List Discovery Benefits From yumpu.com

Dependent Care Expense Eligibility List Discovery Benefits From yumpu.com

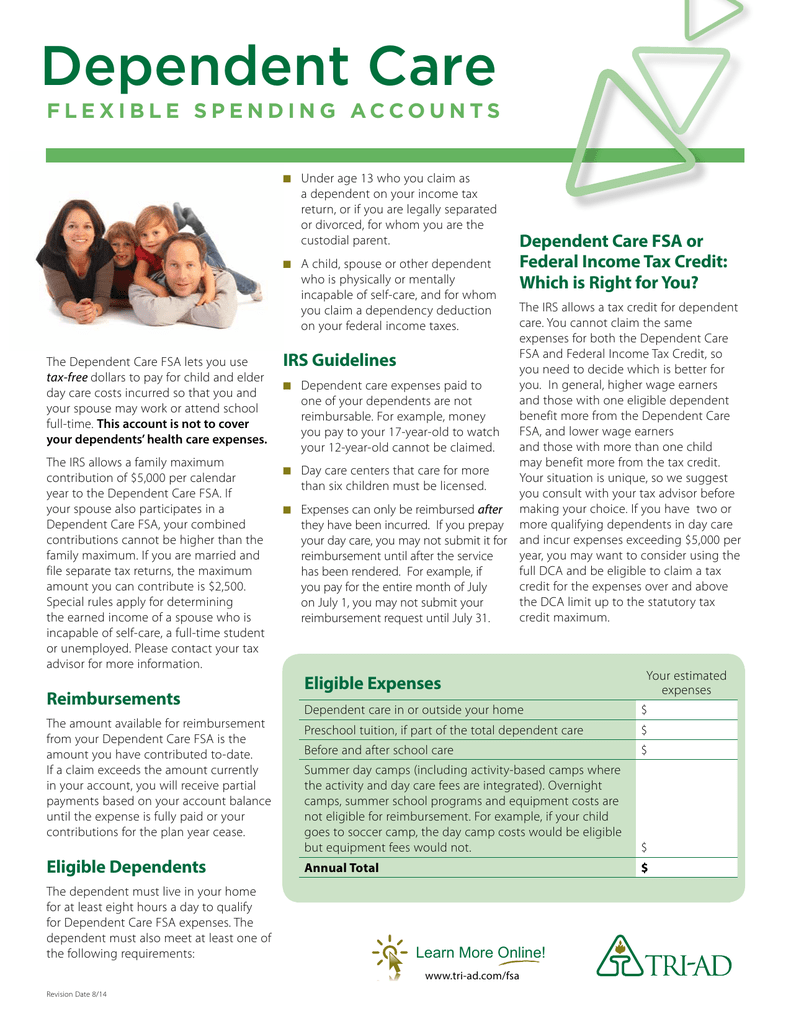

Though prices vary summer day camp programs accredited by the American Camp Association average 314 per week. Take care of your family while making every dollar count. The Dependent Care FSA covers eligible dependent care expenses including preschool summer camp before- and after-school. The Summary Day camp expenses are eligible for reimbursement from a Dependent Care FSA as long as they provide custodial care for children under the age of 13 so the parent s can work look for work or attend school full-time. Lost deposit for changing providers without notice Agency Fees Application Fees Deposits Hold-the-Spot Fees Placement Fees Registration Fees Items that are NOT eligible for reimbursement under a Dependent Care Flexible Spending Account. Dependent Care FSA and Summer Camp This summer use your DCFSA to pay for day camps that your child attends.

Employees who sign up to participate in one can set aside up to 10500 in 2021 to pay for a range of childcare and other dependent care costs.

A DCAP also known as a Dependent Care Flexible Spending Account is an employer-sponsored benefit account. Dependent Care FSA accounts also known as Dependent Care Assistance Program DCAP accounts provide a tax-free way to cover day care related expenses for children under 13 as well as adult dependents. A DCAP also known as a Dependent Care Flexible Spending Account is an employer-sponsored benefit account. The IRS recently released a few tips to help parents or taxpayers with children understand the circumstances in which summer daycare expenses qualify for the Child and Dependent Care Tax Credit. Before and after school care. Summer camp is not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA or a limited care flexible spending account LCFSA.

Source: tampabay.com

Source: tampabay.com

With both the FSA and the child care credit other eligible expenses include the cost of day care or preschool before-school care or after-school care and a nanny or other babysitter while you. The IRS recently released a few tips to help parents or taxpayers with children understand the circumstances in which summer daycare expenses qualify for the Child and Dependent Care Tax Credit. They must also be claimed as dependents on the federal income tax return. To use a Dependent Care FSA for reimbursement on day camp children have to be younger than 13 years old. The Dependent Care FSA covers eligible dependent care expenses including preschool summer camp before- and after-school.

Source: healthaccounts.bankofamerica.com

Source: healthaccounts.bankofamerica.com

If you exclude or deduct dependent care benefits provided by a dependent care benefit plan the total amount you exclude or deduct must be less than the dollar limit for qualifying expenses generally 3000 if one qualifying person was cared for or 6000 if two or more qualifying persons were cared for. Setting aside pretax dollars in a Dependent Care Flexible Spending Account FSA can help you save on child or adult day care expenses. These expenses qualify even if the camp specializes in a particular activity such as computers or soccer. The IRS allows a DCAP to be. Summer camp is not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA or a limited care flexible spending account LCFSA.

Source: washingtonpost.com

Source: washingtonpost.com

Camp and other summer child care costs can be a big line item for working parents. With both the FSA and the child care credit other eligible expenses include the cost of day care or preschool before-school care or after-school care and a nanny or other babysitter while you. Optional Fees are not reimbursable ie. The Dependent Care FSA covers eligible dependent care expenses including preschool summer camp before- and after-school. You are allowed to contribute 5000 a year to a Dependent Care FSA per household or 2500 for married couples who file separately.

Indirect Dependent Care Expenses When these expenses are required in order to obtain care they are reimbursable only after the care has been received. Dependent Care FSA accounts also known as Dependent Care Assistance Program DCAP accounts provide a tax-free way to cover day care related expenses for children under 13 as well as adult dependents. Indirect Dependent Care Expenses When these expenses are required in order to obtain care they are reimbursable only after the care has been received. Setting aside pretax dollars in a Dependent Care Flexible Spending Account FSA can help you save on child or adult day care expenses. Dependent Care FSA and Summer Camp This summer use your DCFSA to pay for day camps that your child attends.

Source: pinterest.com

Source: pinterest.com

Employees who sign up to participate in one can set aside up to 10500 in 2021 to pay for a range of childcare and other dependent care costs. The Dependent Care FSA covers eligible dependent care expenses including preschool summer camp before- and after-school. Though prices vary summer day camp programs accredited by the American Camp Association average 314 per week. Employees who sign up to participate in one can set aside up to 10500 in 2021 to pay for a range of childcare and other dependent care costs. A DCAP also known as a Dependent Care Flexible Spending Account is an employer-sponsored benefit account.

This applies even if the camp specializes in sports ie basketball volleyball etc or computers. Lost deposit for changing providers without notice Agency Fees Application Fees Deposits Hold-the-Spot Fees Placement Fees Registration Fees Items that are NOT eligible for reimbursement under a Dependent Care Flexible Spending Account. Optional Fees are not reimbursable ie. Take care of your family while making every dollar count. These expenses qualify even if the camp specializes in a particular activity such as computers or soccer.

A DCAP also known as a Dependent Care Flexible Spending Account is an employer-sponsored benefit account. Summer Camps Day Camps are eligible for reimbursement with a dependent care flexible spending account DCFSA. Setting aside pretax dollars in a Dependent Care Flexible Spending Account FSA can help you save on child or adult day care expenses. Before and after school care. The IRS recently released a few tips to help parents or taxpayers with children understand the circumstances in which summer daycare expenses qualify for the Child and Dependent Care Tax Credit.

Indirect Dependent Care Expenses When these expenses are required in order to obtain care they are reimbursable only after the care has been received. Summer Day Camps. Setting aside pretax dollars in a Dependent Care Flexible Spending Account FSA can help you save on child or adult day care expenses. They must also be claimed as dependents on the federal income tax return. The IRS recently released a few tips to help parents or taxpayers with children understand the circumstances in which summer daycare expenses qualify for the Child and Dependent Care Tax Credit.

Take care of your family while making every dollar count. Summer camp is not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA or a limited care flexible spending account LCFSA. Using a dependent care FSA can help parents save an average of 30 on these services while also reducing your overall tax burden–. What is summer camp. With both the FSA and the child care credit other eligible expenses include the cost of day care or preschool before-school care or after-school care and a nanny or other babysitter while you.

You can also use the account for dependents age 13 and over who cannot care for themselves while youre at work. Employees who sign up to participate in one can set aside up to 10500 in 2021 to pay for a range of childcare and other dependent care costs. The IRS allows a DCAP to be. Optional Fees are not reimbursable ie. The IRS recently released a few tips to help parents or taxpayers with children understand the circumstances in which summer daycare expenses qualify for the Child and Dependent Care Tax Credit.

Source: studylib.net

Source: studylib.net

The Dependent Care FSA covers eligible dependent care expenses including preschool summer camp before- and after-school. If you exclude or deduct dependent care benefits provided by a dependent care benefit plan the total amount you exclude or deduct must be less than the dollar limit for qualifying expenses generally 3000 if one qualifying person was cared for or 6000 if two or more qualifying persons were cared for. Summer Day Camps. What is summer camp. Though prices vary summer day camp programs accredited by the American Camp Association average 314 per week.

Source: issuu.com

Source: issuu.com

With both the FSA and the child care credit other eligible expenses include the cost of day care or preschool before-school care or after-school care and a nanny or other babysitter while you. Guest Post By Matt Elliott CFP CSLP of Pulse Financial Planning Changes to the 2021 tax code have made planning for your child and dependent care tax benefits even more crucial than in previous years. This applies even if the camp specializes in sports ie basketball volleyball etc or computers. To use a Dependent Care FSA for reimbursement on day camp children have to be younger than 13 years old. You are allowed to contribute 5000 a year to a Dependent Care FSA per household or 2500 for married couples who file separately.

Source: rmr.zendesk.com

Source: rmr.zendesk.com

This applies even if the camp specializes in sports ie basketball volleyball etc or computers. This applies even if the camp specializes in sports ie basketball volleyball etc or computers. Using a dependent care FSA can help parents save an average of 30 on these services while also reducing your overall tax burden–. Summer Camps Day Camps are eligible for reimbursement with a dependent care flexible spending account DCFSA. Summer camp is not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA or a limited care flexible spending account LCFSA.

Source: fsastore.com

Source: fsastore.com

Camp and other summer child care costs can be a big line item for working parents. The Dependent Care FSA covers eligible dependent care expenses including preschool summer camp before- and after-school. You choose an annual election amount up to 5000 per family. Lost deposit for changing providers without notice Agency Fees Application Fees Deposits Hold-the-Spot Fees Placement Fees Registration Fees Items that are NOT eligible for reimbursement under a Dependent Care Flexible Spending Account. Daycare or nursery care.

Source: studylib.net

Source: studylib.net

They must also be claimed as dependents on the federal income tax return. To use a Dependent Care FSA for reimbursement on day camp children have to be younger than 13 years old. Take care of your family while making every dollar count. The IRS recently released a few tips to help parents or taxpayers with children understand the circumstances in which summer daycare expenses qualify for the Child and Dependent Care Tax Credit. Using a dependent care FSA can help parents save an average of 30 on these services while also reducing your overall tax burden–.

16 rows Various Eligible Expenses You can use your Dependent Care FSA DCFSA to pay for a. Using a dependent care FSA can help parents save an average of 30 on these services while also reducing your overall tax burden–. These expenses qualify even if the camp specializes in a particular activity such as computers or soccer. Setting aside pretax dollars in a Dependent Care Flexible Spending Account FSA can help you save on child or adult day care expenses. Though prices vary summer day camp programs accredited by the American Camp Association average 314 per week.

Source:

Source:

Guest Post By Matt Elliott CFP CSLP of Pulse Financial Planning Changes to the 2021 tax code have made planning for your child and dependent care tax benefits even more crucial than in previous years. The IRS allows a DCAP to be. They must also be claimed as dependents on the federal income tax return. Check out the list of Dependent Care FSA eligible expenses below. A DCAP also known as a Dependent Care Flexible Spending Account is an employer-sponsored benefit account.

Source: tacanow.org

Source: tacanow.org

You can also use the account for dependents age 13 and over who cannot care for themselves while youre at work. Setting aside pretax dollars in a Dependent Care Flexible Spending Account FSA can help you save on child or adult day care expenses. The Summary Day camp expenses are eligible for reimbursement from a Dependent Care FSA as long as they provide custodial care for children under the age of 13 so the parent s can work look for work or attend school full-time. Daycare or nursery care. You choose an annual election amount up to 5000 per family.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title dependent care fsa eligible expenses summer camp by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.